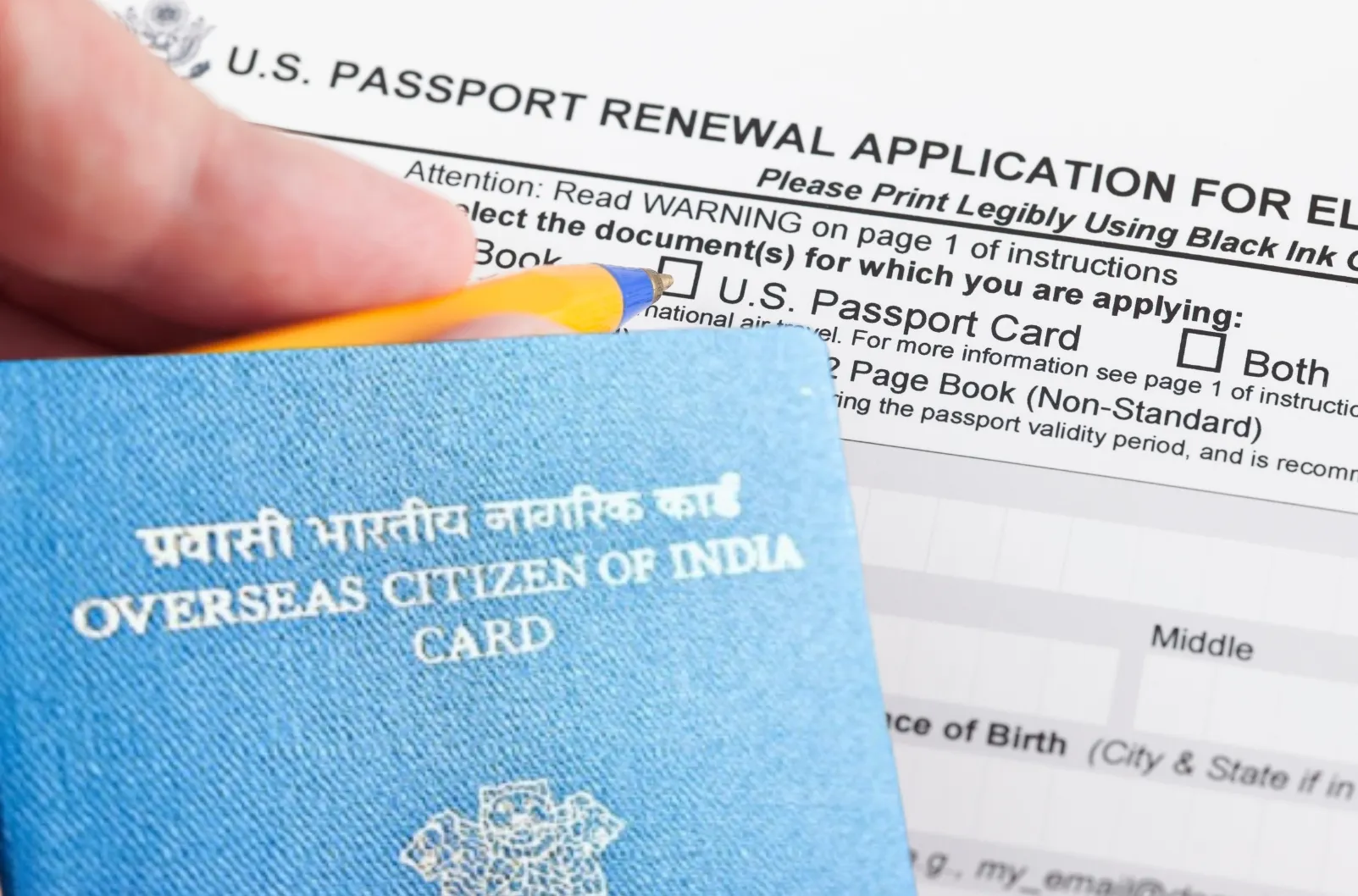

NRI/OCI bank accounts

We're found 9+ related topics

Showing 1–10 of 9 Results

Want access to our premium video content?

Subscribe nowPopular Category

Popular Topics

-

1

1

-

2

2

-

3

3

-

4

4

-

5

5

-

6

6

-

7

7

-

8

8

- View All Topics